Driving National Food Resilience Through Vertical Agribusiness Integration

Dear Subscribers,

Welcome to Foundry Digest, your weekly briefing from Foundry Collective.

In this edition, we spotlight how Agricon is driving national food resilience through vertical agribusiness integration: reducing import reliance, strengthening upstream capabilities, and equipping smallholder farmers with accessible technology and climate-ready solutions.

We also highlight Indonesia’s smart farming momentum through Agrari’s data-driven model and share key ecosystem updates across circular economy policy, EV adoption trends, and institutional investment movements shaping Indonesia’s future.

Don’t miss the Indonesia Food Resilience Forum 2025 – a half-day conference featuring industry leaders and the launch of “Food Resilience through Innovation & Technology.” This is your opportunity to connect with key players shaping the future of agriculture and food systems in the region. More info: https://luma.com/75o04yki.Stay ahead,

The Foundry Team

🚀Agricon’s Strategy to Curb Imports and Empower Farmers

Amid the challenges of climate change and global economic fluctuation, national food resilience can no longer rely solely on expanding land acreage. The key now shifts to supply chain efficiency and technological independence in agriculture. PT Agricon, a major player in Indonesia’s agribusiness sector, is answering this challenge through an aggressive vertical integration strategy, moving the production of agricultural inputs onshore and bringing innovative technology directly into the hands of smallholder farmers.

Dave Bengardi, CEO of Agricon, emphasizes that the future of Indonesian agriculture depends on the industry’s ability to reduce import dependency through integrated upstream and downstream initiatives.

Building Independence from the Upstream

Agricon’s grand strategy is currently focused on “going more upstream” in the agri-input supply chain. This move is not merely business expansion; it is a strategic effort to reduce reliance on imported raw materials and create products more relevant to local conditions.

“Integration for Agricon today is going more upstream in our agri inputs field. This is defined for us as trying to bring more of production of agriculture inputs into the country,” says Dave Bengardi. He cites the domestic production of suspension concentrate (SC) formulations and corn seeds as key examples.

This step allows Agricon to customize seed genetics to fit specific challenges across different regions of Indonesia.

“With more control over the seed that we sell to farmers we are able to customize the genetics in order to fit with farmer needs. In certain areas of Indonesia farmers face soilborne diseases such as downy mildew that can drastically reduce production. We can create seed that have higher resistances to this,” Dave explains.

Lowering Technology Barriers for Smallholder Farmers

One of the greatest paradoxes in Indonesian agriculture is the availability of advanced technology that remains unaffordable for farmers with low average incomes. Agricon’s vertical integration aims to cut supply chain inefficiencies so that cutting-edge technology becomes accessible at a reasonable price point.

Dave highlights that the technology to drastically improve yields is available, yet the barrier to entry for farmers remains too high.

“Yield improvement at farmer level can reach 20-30% with better technology. More importantly, we help farmers reduce the downside risk of farming which is often the bigger problem with farming in Indonesia,” he states.

A concrete example of this approach is the launch of “Brofreya,” an insecticide developed in partnership with Mitsui Chemicals. This technology successfully cut the spray program for shallot farmers from 10-15 times a season to just 3-5 times. This efficiency not only reduced labor costs but also increased yields by 10-15% due to more effective pest control.

Climate Adaptation: Innovation Amidst Uncertainty

Food resilience also means climate resilience. Facing phenomena like La Niña and increasingly unpredictable weather, Agricon has introduced practical innovations such as the “Suryakencana” drying system. This system is essentially a modified greenhouse turned into a drying house, enabling farmers to dry crops 50-70% faster without relying on electricity.

“This year with La Nina has been quite a difficult year for farmers in the horticulture sector... Our products have been able to at least protect farmers from the downside risk by helping them navigate the disease pressure,” adds Dave.

Collaboration for a Stronger Ecosystem

Agricon recognizes that food resilience cannot be achieved in isolation. The company actively partners with universities for bio-product research and works with the government (Ministry of Industry and Ministry of Agriculture) to set pesticide standards that protect farmer interests.

Furthermore, Agricon acts as a bridge in the downstream sector. “Agricon often works together with partners that are on the post harvest side of the business to connect our farmers to buyers that have better and/or more stable pricing,” says Dave, referring to initiatives that connect corn farmers directly to industrial buyers.

Through comprehensive vertical integration (from seed research in the lab to post-harvest market connectivity) Agricon proves that the path to national food resilience must be built on a foundation of industrial independence and a commitment to farmer welfare.

📊 Indonesia’s Agritech Revolution

This insight is featured in the upcoming report “Food Resilience through Innovation and Technology,” which Foundry Collective will launch at the Indonesia Food Resilience Forum 2025 tomorrow. Indonesia’s agricultural sector is undergoing a fundamental transformation, shifting from traditional farming methods to data-driven approaches. Smart farmingis driving this change, advancing through five progressive levels from software and hardware to automation, data analytics, and artificial intelligence. These precision technologies enable farmers to optimize resources, increase yields, and build resilience across crops, livestock, and aquaculture.

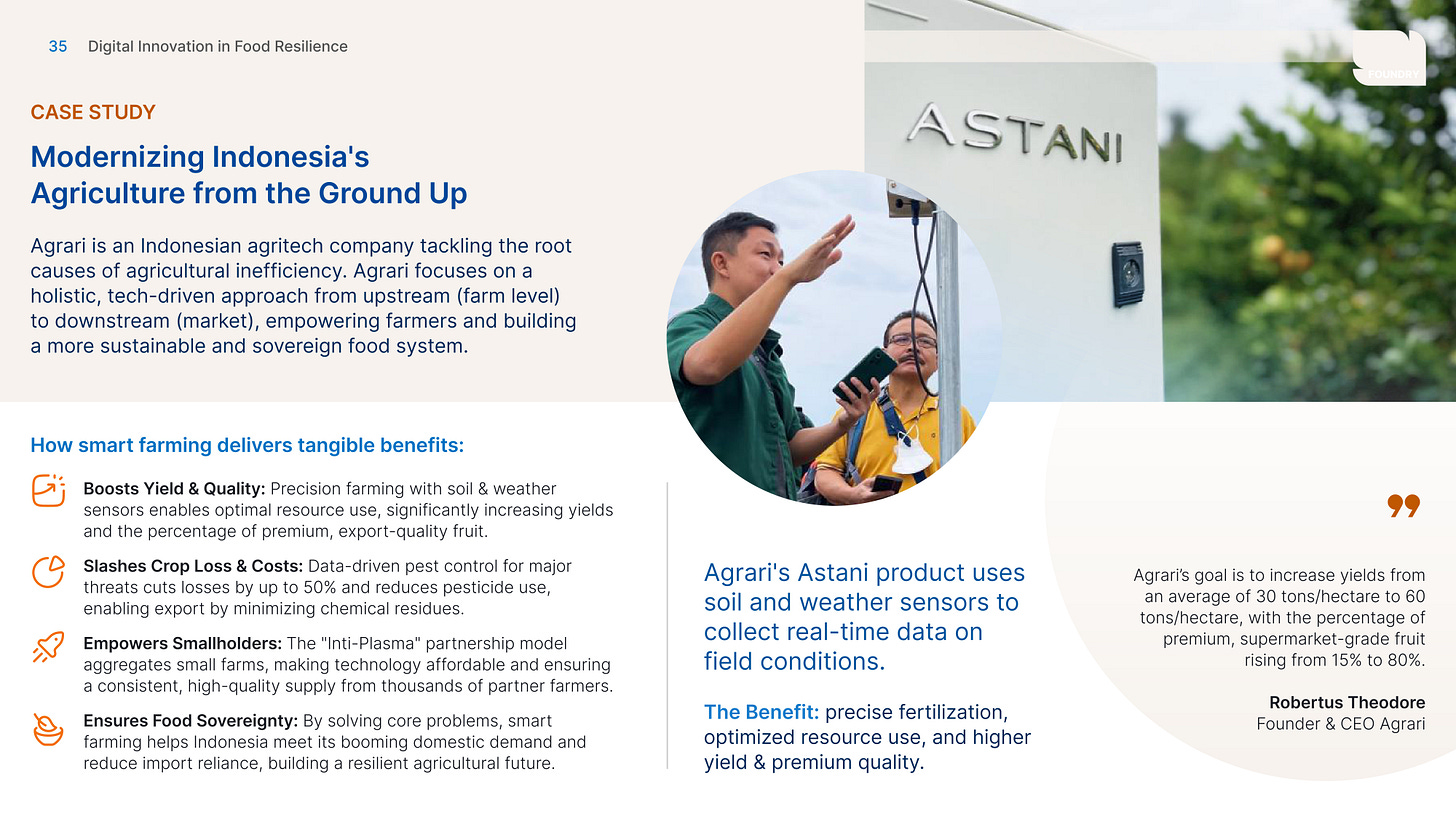

Agrari, a homegrown agritech company, demonstrates how smart farming directly tackles agricultural inefficiency. Using its Astani product with soil and weather sensors to collect real-time field data, Agrari achieves measurable results: higher yields, up to 50% reduction in crop losses through data-driven pest control, and empowerment of smallholder farmers through its Inti-Plasma partnership model. This end-to-end approach (from farm level to market) creates a more sustainable and self-sufficient food system while minimizing chemical residues for export compliance.

Agrari’s targets tell the full story: doubling yields from 30 to 60 tons per hectare and increasing premium, export-quality fruit from 15% to 80%. By solving core agricultural challenges through digital innovation, smart farming strengthens individual farmers while advancing Indonesia’s food sovereignty. This enables the country to meet rising domestic demand and reduce import dependency, building a more resilient agricultural future.

⚙️ Industry Dynamics

Here are some noteworthy ecosystem-related developments from Indonesia worth exploring.

Indonesia and Germany have launched the InCircular project to accelerate the country’s circular economy transition. The five-year collaboration between Bappenas and GIZ will support the Circular Economy Roadmap & Action Plan 2025–2045, focusing on stronger regulations, capacity building, improved coordination, and upgraded waste-management systems in East Java, Bali, and Jakarta. The initiative aligns with Indonesia’s existing policies, including mandatory EPR, closing open-dumping landfills, green industry standards, and waste-to-energy development, to cut waste and boost resource efficiency. [Read more]

Indonesia’s electric vehicle (EV) market grew 49% this year even as conventional car sales fell 11%, according to PwC. Weak economic conditions slowed overall vehicle demand, but EV adoption continued to rise due to tax incentives and battery investment progress. While below the ASEAN average EV growth of 62%, Indonesia is seeing increasing interest, with 14% already owning EVs and 70% considering purchase. Thailand and Vietnam remain regional leaders with adoption above 30%. [Read more]

BPJS Ketenagakerjaan is exploring investment opportunities in global AI infrastructure companies, including those in the U.S., Taiwan, Japan, and South Korea, as part of a strategy to diversify its portfolio and tap into the rapidly growing AI supply chain sector. Managing IDR879 trillion in assets, the institution has requested approval to invest up to 5% overseas, focusing on data centers, energy providers, and cable network companies rather than core chipmakers, though options like Nvidia remain under consideration. The initiative awaits government regulatory clarity and hinges on rupiah stability, while BPJS also targets doubling domestic equity allocation to 20% over the next three years. [Read more]