How Indonesia is Working to Fix Its Horticulture Value Chain

Dear Subscribers,

Welcome to Foundry Digest, your weekly briefing from Foundry Collective on Indonesia’s technology and investment landscape.

In this edition, we explore strengthening Indonesia’s horticulture value chain, highlight data on the country’s growing digital economy, and share the latest industry dynamics.

Whether you’re tracking innovation, investing, or shaping policy, Foundry Digest delivers sharp, actionable insights to keep you ahead.

Stay ahead,

The Foundry Team

🚀 Inspiring Story: Agrari’s Bid to Repair Indonesia’s Horticulture Value Chain

In Indonesia’s agriculture industry, fruit fly infestations are often underestimated, but their impact ripples across the entire horticulture value chain. The effects range from crop failures and downgraded fruit quality to eroded market trust and mounting farmer debt.

Agrari, an agritech startup focused on improving fruit harvest quality through technology, argues that the root cause of Indonesia’s low fruit quality lies upstream: persistent fruit fly attacks that are not being handled properly.

“We initially focused downstream by acquiring a post-harvest patent. But if the fruit arriving at the packing house is poor quality, it’s pointless. The root problem is upstream,” said Agrari Founder & CEO Robertus Theodore in an exclusive interview.

Agrari is an agriculture technology company dedicated to overhauling the horticulture value chain, especially for fruit commodities. Through a core-plasma partnership model, modernized cultivation, and integrated tech solutions, the company aims to lift productivity, improve harvest quality, and raise farmer incomes.

Founded in 2022, Agrari is transforming agriculture with innovative technology designed to empower farmers and promote sustainable practices. Its flagship product, ASTANI (short for “Farming Assistant” in Indonesian) is the country’s first Tree and Soil Sensing Sensor, specifically developed for fruit plantations. Leveraging IoT and AI, ASTANI standardizes harvests, detects pests, monitors plant growth, and tracks fruit development.

Complementing ASTANI, Darifarm delivers premium, high-quality produce from Agrari-supported farms, helping farmers meet market demand for superior yields. By equipping farmers with advanced tools to understand soil, plant, and weather conditions, Agrari enables precise plant care and exceptional harvests. At present, the company is rolling out integrated pest-management (IPM) programs and targeting significant plasma-area expansion over the next few years.

The Domino Effect of Fruit Flies

Robert explained that fruit fly attacks on citrus, mango, starfruit, and guava can cause up to 50% crop failure. Infected fruit often rots during distribution, contaminates other produce, and undermines buyer confidence.

“As a result, prices are suppressed and farmer incomes plunge. To cover losses, farmers reduce fertilizer use, leading to less sweetness and weaker fruit resilience. It’s a vicious cycle,” he added.

Heavy reliance on chemical pesticides also leads to residue buildup on fruit, constraining export potential and posing health risks to consumers.

An Integrated “Painkiller”

In response, Agrari has developed a bundled, integrated solution, its “painkiller” for farmers, modeled after a military strategy: establish perimeters, deploy traps, and sanitize orchards.

“We’re not anti-pesticide, but usage must be data-driven. We install traps to monitor infestation levels. If pressure spikes within a certain radius, we conduct targeted spraying,” Robert said.

The method also includes weather and soil monitoring via sensors, as well as a core–plasma partnership approach to consolidate smallholders.

Within two years, the approach has begun to show results. Average plasma-orchard productivity increased from around 30 tons per hectare to 38 tons per hectare. Premium-grade fruit (supermarket class) rose from 15% to at least 50%, with a target of 80%.

“Most importantly, the fruit has minimal chemical residue because we use more environmentally friendly inputs,” Robert emphasized.

Expansion Plans and Scaling

Agrari currently manages more than 150 hectares of plasma orchards and plans to expand to as much as 2,500 hectares within the next two years, with North Sumatra as a priority.

“By controlling fruit flies across 20% of key citrus areas, we can significantly suppress pest populations. Cultivation costs fall, quality rises, and only then can we confidently enter domestic and international markets,” he said.

While upstream challenges such as farmer mindsets and land fragmentation remain significant, Robert is optimistic about the sector’s outlook.

“Domestic fruit consumption is still 50% below the standard. The market opportunity is huge. With modernization and the right approach, we can not only meet domestic needs but also become a credible export player,” he concluded.

The war against fruit flies is more than a harvest issue, it is a strategic step toward healthier, more sustainable food security that benefits farmers.

📊 Data & Insight: How SEA’s Digital Economy Strengthens Food Resilience

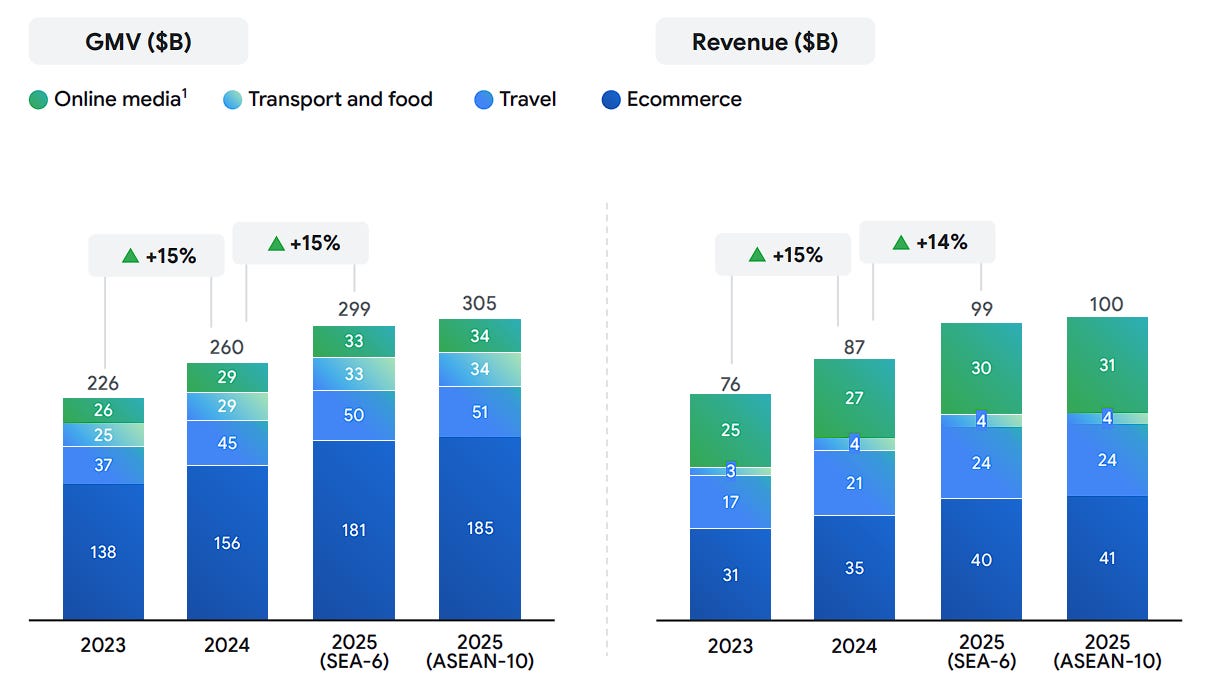

Southeast Asia’s digital economy continues to grow steadily, with a projected GMV of over US$300 billion by 2025 and an annual growth rate of around 15%. Core sectors such as e-commerce, digital finance, and on-demand services are shifting toward sustainable monetization. Video commerce already accounts for 25% of e-commerce GMV, while digital payment infrastructure is rapidly expanding across borders. As digital platforms mature, they increasingly play a role beyond consumer services, supporting broader development goals including food security.

Digital technologies have become a critical component across real sectors, serving as essential tools in advancing food resilience initiatives. In the Southeast Asia region, with climate change and supply chain disruptions threatening food systems, digital platforms help improve farming efficiency, reduce post-harvest losses, and connect producers to markets. AI-powered advisory apps, IoT sensors, and digital payment integration provided by agritech innovators enable small farmers to make better decisions, access financial services, and sell produce more efficiently. These capabilities are crucial to building resilient food systems that can withstand external shocks and feed growing populations.

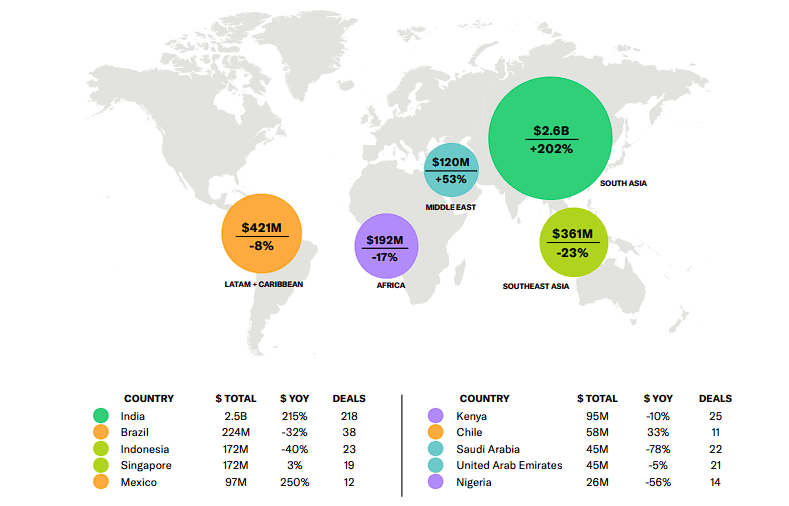

The agritech sector has seen rising investor interest in SEA, reaching US$2.6 billion in funding in 2024. With more than 270+ startups active in the region, solutions range from precision agriculture and drone monitoring to online marketplaces for surplus produce. Agritech not only helps optimize inputs and increase yields but also supports sustainability by reducing waste and enhancing supply chain transparency. As such, it is increasingly seen as a strategic pillar of both digital economy growth and food security policy.

In Indonesia, agritech plays an important role in efforts to secure food resilience for its 33 million smallholder farmers. Local startups such as Eratani, Agrari, and Chickin offer digital solutions for crop planning, livestock monitoring, and supply chain logistics. Government support for smart farming and rural digital access further accelerates adoption. With strong alignment between digital innovation and national food goals, Indonesia illustrates how the digital economy can directly contribute to building a more secure and sustainable food future.

⚙️ Industry Dynamics

Here are several noteworthy news updates from Indonesia’s ecosystem worth exploring.

Living Lab Ventures, the corporate venture arm of Sinar Mas Land, has launched the Japan Thematic Fund in partnership with Spiral Ventures to strengthen Japan–Southeast Asia investment collaboration, with Indonesia as the main focus. The fund brings together strategic investors including Cool Japan Fund, Bank Danamon (part of MUFG Group), Rohto Pharmaceutical, Advasa, and Culture Convenience Club (TSUTAYA Group). Their participation reflects Japan’s growing interest in Southeast Asia’s creative economy, technology, and urban innovation, while positioning BSD City as a regional smart city hub and a bridge for cross-border startup collaboration throughout Southeast Asia. [Read More]

Indonesia’s online spending surged 6.19% quarter-on-quarter in Q3 2025, with Bank Indonesia recording IDR134.7 trillion in e-commerce transactions—up 4.93% from Q2. The increase was fueled by nationwide discount campaigns such as 7.7, 8.8, and 9.9, boosting participation across top local e-commerce players ahead of 11.11. Electronics, food and beverages, and beauty products led sales, while Eastern Indonesia saw the fastest growth. Despite seasonal shifts in consumption, household spending remains resilient, keeping Indonesia’s digital economy on an upward trajectory. [Read More]