The Closed-Loop Model Transforming Indonesian Agriculture

Dear Subscribers,

Welcome to Foundry Digest, your weekly briefing from Foundry Collective.

In this edition, we dive into how Chickin is transforming poultry farming through innovative financing and smart technology, explore agriculture’s growing role in Indonesia’s impact investing landscape, and share critical ecosystem updates on major funding initiatives and regional ventures.

Don’t miss the Indonesia Food Resilience Forum 2025 – a half-day conference featuring industry leaders and the launch of “Food Resilience through Innovation & Technology.” This is your opportunity to connect with key players shaping the future of agriculture and food systems in the region.Stay ahead,

The Foundry Team

🚀 Closed-Loop Model: How Chickin Saves Poultry Farmers from Price Volatility

Indonesia’s poultry industry contributes IDR700 trillion to the national economy, yet farmers often suffer massive losses. Chicken prices fluctuate drastically within hours, making survival difficult. Farmers commonly profit for six months and lose money the other six months annually.

Chickin, an agritech company founded in 2017, solves this through a closed-loop business model integrating financing, smart farming technology, and supply chain management.

“The poultry industry is volatile. The harvest cycle takes only 30-45 days. In this short timeframe, chicken prices fluctuate drastically,” explains Tubagus Syailendra (Tebe), Co-Founder & CEO Chickin.

This creates extreme uncertainty. When supply exceeds demand, prices collapse despite farmers’ significant production costs.

“Many Indonesian farmers cannot survive because they depend on extremely high price risks,” Tebe adds.

Chickin’s Solution: Three Integrated Strategies

1. Input Financing, Not Cash

Chickin directly purchases chicken feed from suppliers with cash payment rather than giving farmers cash. This creates two advantages: Chickin achieves economies of scale through bulk buying and secures large discounts, which farmers automatically benefit from. Feed efficiency improves by 30%.

2. Smart Farming

Chickin provides technology to maximize productivity:

Online dashboard: Replaces manual records with AI-powered automatic systems

Climate control hardware: Automates temperature, humidity, and oxygen regulation

AI and computer vision: Enables digital weighing and production uniformity

“When yield improves, we can achieve up to 30% efficiency gains in feed costs. In terms of mortality, we can improve it by around 50%,” Tebe states.

3. 100% Offtake Guarantee

When farmers harvest, Chickin automatically purchases all output at agreed prices. Farmers avoid unsold inventory or below-market sales. Chickin achieves this through vertical integration: processing facilities, 13 cold chain hubs, and restaurant brands in 12 cities.

Scale and Impact

Chickin’s model has delivered impressive growth:

12,000 coops using Chickin’s app

88 million chickens in ecosystem

IDR 1.5 trillion financing distributed annually

3 million chickens under financed contracts

However, Chickin is highly selective—only 5% of the 88 million chickens in its ecosystem receive Chickin financing. “We provide to the best of the best farms only, based on historical data, which is around 5 percent,” he explains. This standard ensures sustainability and model quality.

Surviving Crisis

During 2022-2023 oversupply crisis, when prices collapsed, Chickin survived by maintaining healthy unit economics and measured growth. “We grow slowly, carefully optimizing every cost component,” Tebe states.

Chickin also leverages purchasing power to negotiate better prices with major feed producers.

The government’s Free Nutritious Meal Program (MBG) is projected to increase chicken demand by 20% of national needs. “From the 330 trillion MBG budget, 60% goes to raw materials. Around 100 trillion will be added for protein—chicken and eggs,” Tebe explains.

Indonesia has the lowest per capita protein consumption in Southeast Asia. With rising incomes and government programs, demand will continue growing.

“Now is the right time to invest in agriculture. Everyone focuses on food security,” he adds.

Weak cold chain infrastructure remains a bottleneck. Chickin plans further investment in this area to strengthen the supply chain.

📊Agriculture Becomes Top Priority in Indonesia’s Impact Investing Landscape

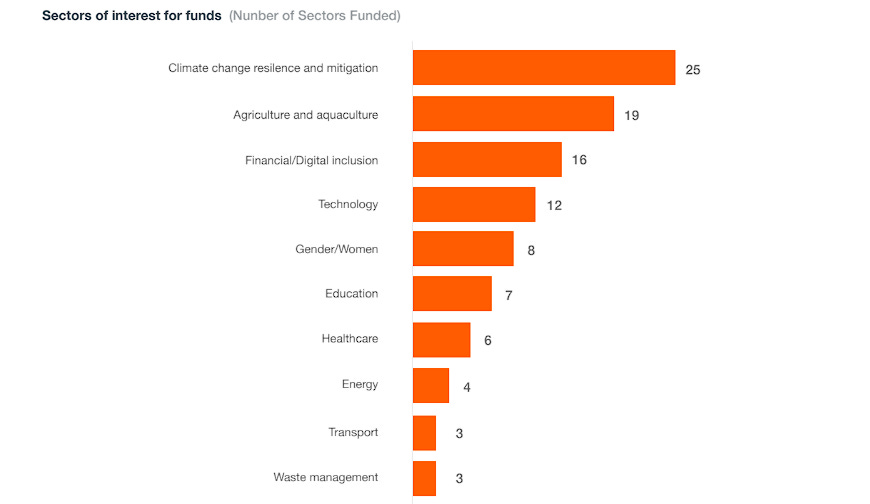

Agriculture has become the second most-funded sector in Indonesia’s impact investment landscape, with 19 of 57 funds targeting agricultural sustainability according to the Indonesia Impact Alliance 2024 report. Yet a critical funding gap exists for enterprises needing USD100,000 to USD1 million. This USD50.8 billion annual gap leaves one in four agricultural companies without access to suitable impact investors.

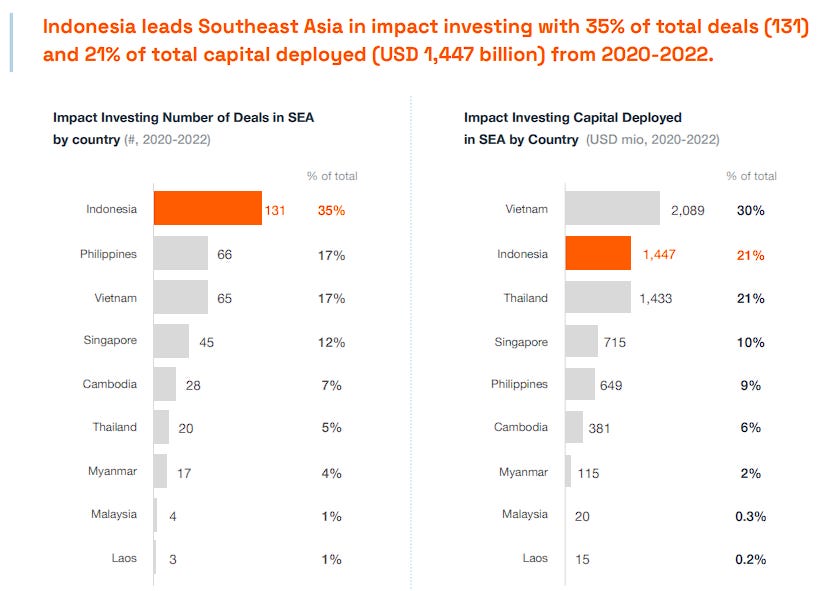

The sector is also shifting from Development Finance Institution dominance toward private investors, with USD1.44 billion deployed in 2020-2022, making Indonesia Southeast Asia’s most active impact investing market. Agricultural funds use mixed equity-debt strategies, though collateral requirements and longer investment timelines remain barriers to capital access.

The research proposes an Indonesian Impact Investment Wholesaler to aggregate capital through blended finance and channel it via smaller funds (USD30 million and below). This model can unlock private investment in sustainable agriculture while reducing risk, creating a multiplier effect for agricultural growth and Indonesia’s SDG progress.

⚙️ Industry Dynamics

Here are several ecosystem updates from Indonesia that are worth following.

Indonesia’s BPJS Ketenagakerjaan explores AI infrastructure investment opportunities overseas, targeting companies in the U.S., Taiwan, Japan, and South Korea. The agency aims to diversify its portfolio within the expanding AI supply chain ecosystem—focusing on data centers, energy suppliers, and cable infrastructure rather than core chip manufacturers. BPJS Ketenagakerjaan manages Rp879 trillion in assets and is awaiting government approval to invest up to 5% abroad. [Read more]

NTT Group has launched its first Southeast Asia startup investment vehicle, Synexia Ventures, based in Singapore and set to begin operations on December 15, 2025. The fund, jointly managed by NTT DOCOMO Ventures and NTT Finance alongside regional VC leader Kuan Hsu, will invest in startups across Singapore, Indonesia, Malaysia, and the Philippines, particularly in AI, IoT, smart cities, robotics, and drones. The initiative aims to accelerate collaboration with local innovators and strengthen NTT’s business expansion in the region. [Read more]