Investing in Resilience to Power Indonesia’s Food Future

Dear Subscribers,

Welcome to Foundry Digest, your weekly briefing from Foundry Collective.

In this edition, we highlight Kejora Capital’s investment strategy, global leadership data driving food-system transformation, and other key updates from the ecosystem.

We’re also pleased to invite you to the Indonesia Food Resilience Forum 2025, a half-day conference featuring key leaders in agriculture and food innovation, along with the launch of the report “Food Resilience through Innovation & Technology.”

Register here: bit.ly/IFRF2025.Stay ahead,

The Foundry Team

🚀 Kejora Capital’s Staged Investment Strategy for Supporting Indonesia’s Food Resilience

In the investment map of Southeast Asia, Indonesia’s agriculture technology (agritech) sector is often viewed as a challenging terrain. Yet, for Kejora Capital, this is precisely where golden opportunities lie. With a measured, step-by-step investment approach that starts at the production level, they are proving that building food resilience is not only impactful but also commercially viable.

Behind the estimated US$30 to 40 billion potential of Indonesia’s agricultural output lurks a set of classic challenges: an aging farmer population, productivity lagging behind neighboring countries, and relentless conversion of arable land.

While many investors, particularly global players, remain hesitant to dive in, Andreas Surya, Partner & Director of Investment at Kejora Capital, sees a missed opportunity.

“There is a commercial interest because the size of this market is quite significant. But on the other hand, we are also concerned about the sustainability of this sector,” Surya stated in an interview on the agritech investment landscape.

For Kejora, investing in agritech is not a leap of faith, but a gradual journey beginning with the most fundamental layer: production.

Starting Upstream: Strengthening the Production Foundation

Instead of immediately targeting supply chain logistics, fintech, or crop insurance, Kejora chooses to first focus on enhancing production capacity at the farmer level.

“I believe this will come in stages. So, the first thing we must focus on is our output. Technologies that strengthen the robustness of out-yield from agri-farms, aquaculture, and so on. That comes first,” Surya emphasized.

The logic is simple: without quality and quantity in production, it is impossible to build a resilient value chain. Once production is stable and efficient, supporting aspects like access to financing, insurance, and food waste reduction can be integrated more easily.

“If the production is good, the goods are of high quality, then even securing insurance will be easier. It will be cheaper, simpler, and more players will enter. Why? Because the foundation is solid,” he explained.

Appropriate Tech and Scalability

When evaluating agritech startups, Kejora looks beyond market size and the founding team. Technical aspects and long-term sustainability are key considerations.

“We want to look at the longer-term angle, like climate resilience. Will this solution help to address future challenges, not just current ones?” Surya added.

Scalability is also critical. Can a solution that works in one region be replicated elsewhere? The business model and operational processes are specific points of assessment, alongside traditional metrics like traction and unit economics.

Despite having a clear strategic map, Kejora recognizes that transforming the agritech sector is impossible to do alone. They actively facilitate multi-stakeholder collaboration, connecting startups with corporations, government bodies, and farmers.

Looking five years ahead, Surya’s hope is simple: to see more local fruits like Malang Apples or Medan Oranges filling the shelves of domestic supermarkets, replacing imported produce. This would be a tangible indicator that Indonesia’s agritech ecosystem has grown robust.

Kejora’s staged strategy carries an optimistic message: building food resilience is a marathon, not a sprint. With a strong production foundation, appropriate technological support, and tight collaboration, investing in Indonesian agritech is not just about profit and loss; it is about sowing the seeds for a more sovereign and resilient nation in the future.

📊 Global Leaders Call for Food System Transformation

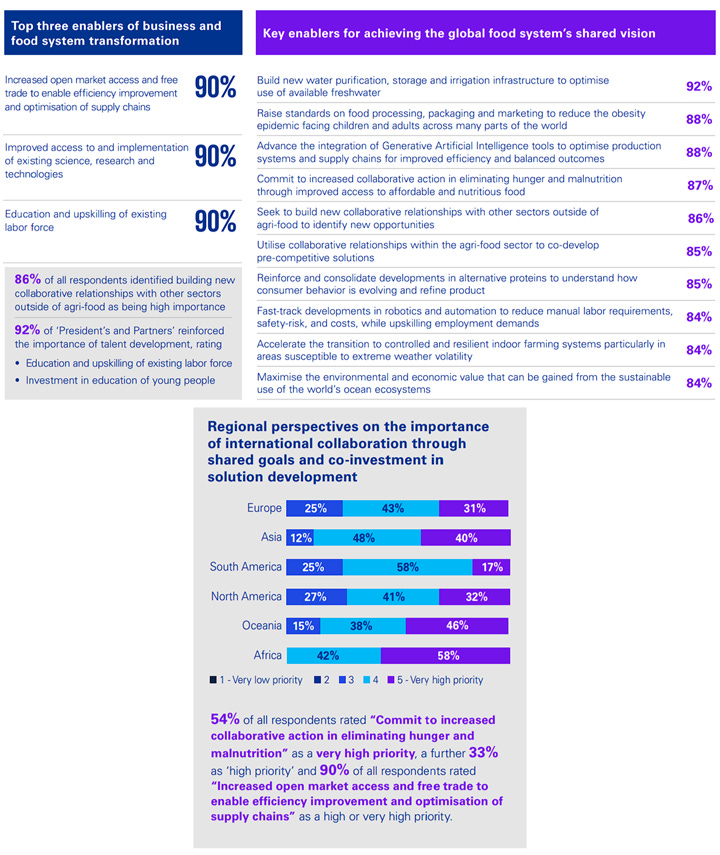

A KPMG survey of more than 200 global business leaders shows clear agreement that the current food system is not resilient enough to handle rising environmental, geopolitical, and economic pressures. Leaders highlight the need for a shift toward a more regenerative and inclusive system that protects ecosystems and better supports smallholder farmers.

Most leaders also stress that real change requires cross-sector collaboration. Agriculture alone cannot drive the transformation; technology providers, financial institutions, energy companies, logistics networks, and governments must work together to strengthen long-term food security.

Technology is seen as the strongest catalyst. Leaders point to digital supply chains, precision agriculture, and data-driven tools as key enablers. Yet they also acknowledge major obstacles, including misaligned policies and high upfront technology costs, which currently slow progress.

⚙️ Industry Dynamics

Here are several noteworthy news from Indonesia’s ecosystem worth exploring.

Louis Dreyfus Company (LDC) is strengthening its commitment to Indonesia in 2025 with major investments, including a new glycerin refining plant with a 55,000-ton annual capacity and a new edible oil packaging line in Lampung. Despite global geopolitical and regulatory challenges, the company reported 4.4% volume growth in the first half of 2025. LDC continues to support local farmers through training, sustainability programs aligned with ISCC and RSPO standards, and initiatives that empower women in agriculture. These developments underscore LDC’s long-term strategy to advance downstream operations, boost supply chain resilience, and deepen its economic contribution to Indonesia. [Read More]

At COP30, Indonesia officially released its Blue Carbon Roadmap and Action Guidelines, developed by multiple ministries with international support. The document sets a unified national framework for high-integrity blue carbon implementation across coastal and marine ecosystems, integrating mangroves, seagrasses, and tidal marshes into emission-reduction strategies and the national carbon economy system. The roadmap positions blue carbon as a key component of climate policy while unlocking benefits such as biodiversity protection, coastal resilience, and sustainable economic opportunities. [Read More]